|

| Click to Learn More |

But even as drug prices and access have become increasingly at the mercy of PBMs, how they operate has remained mostly hidden. Earlier this year, Community Oncology Alliance, an advocacy organization for community-based cancer care practices, commissioned a report exposing how PBMs work and the damage they are causing. Newsweek spoke with COA Executive Director Ted Okon about what many health care experts believe is Big Pharma’s latest villain.

So how do PBMs cause drug prices to increase?

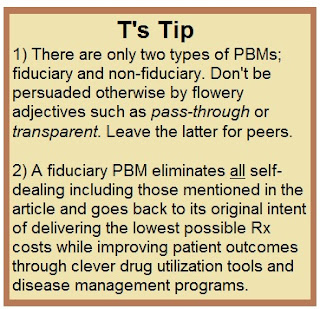

This issue is a murky one, mainly because PBMs lack transparency. I have heard these companies emphasize the importance of transparency except for their interactions with drug companies. PBMs assert that these interactions are the “secret sauce” that enables them to keep prices down. But I have come to the conclusion that this lack of transparency is actually driving prices up.

What is happening behind the scenes?

Let’s say a manufacturer assigns a list price of $10 to a given drug. The PBM then tells the company that it will not list the drug on its formulary unless it receives a discount. The willingness of the manufacturer to discount the drug, and the extent of that discount, is guided by a few factors: the power of the PBM, which the consolidation of companies has increased; how many other competitive products exist; and also the size of the pharmaceutical company.

The pharmaceutical company offers the PBM a discounted price of $8. If the PBM does not accept that price, then the company may offer a rebate of an additional $2 if sales of the drug reach some designated amount. The more powerful a PBM is, the greater discount they can demand—and the fact that three PBMs control the vast majority of the market makes these three companies very powerful.

But how does this negotiating practice lead to higher drug prices?

PBMs want to make money. To do so, they charge fees to pharmacies, whether it’s a retail business or a community oncology practice. At community oncology practices, these fees have increased dramatically in recent years, from 3 percent up to 11 percent. Cancer medications are already expensive, and now PBMs are imposing an additional fee calculated as a percentage of the cost of that pricey drug.

In light of these practices, PBMs make more money from paying closer to the list price and receiving a rebate rather than an upfront discount. The higher the price of the drug, the higher the PBM fee at the pharmacy. So they don’t have an incentive to drive upfront prices down as much as they can. They are taking fees based on the list price, but the net price that the PBM is paying for the drug is much lower than that because of rebates.

In addition, pharmaceutical companies now anticipate steep discounts and rebates when they set their list prices. As a result, they set list prices higher so that the eventual negotiated price will be as high as possible.

How does this approach affect patients?

Patients are being affected in many ways. In terms of cost, patients are now paying copays to their insurers for medications, and they are paying, directly or indirectly, the PBM fee. And all these fees are based on the list price, which is not really what the PBM is paying.

The more patients on Medicare pay for prescription drugs, the faster they enter the so-called “doughnut hole,” when they are responsible for all their health care costs. And the faster they enter the doughnut hole, the faster they leave it, which increases taxpayer-funded Medicare costs.

Read more >>