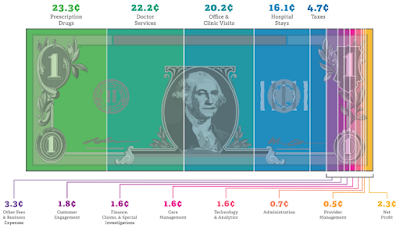

BCBS of Tennessee: Prescription Drugs Have Become the Single Leading Cost Driver

|

| Source: America’s Health Insurance Plans (AHIP) |

PBMs have moved into the medical benefit to manage prescription drug utilization and spend. Despite the trend, most self-funded employers, benefits consultants and brokers spend considerably more time managing the medical benefit (that part which excludes prescription drugs) than the pharmacy benefit. Is it because medical management is a comfort zone and the shift to prescription drugs, as the leading cost driver, requires additional education? More education is a tough sell for a busy professional 50 years of age or older who already has a college degree and professional credential or two. This age group 50+ also just happens to be the demographic with the largest number of covered lives under care. Some have been desensitized to the plight of the employer or patient and care only about the almighty dollar bill. A clear indication money might be most important is when you hear a consultant, CHRO or CFO refer to a covered life as a “belly button,” for example. Whatever the reason it’s concerning to say the least. Stakeholders, including patients, want more. No scratch that….they need more. Learn how to manage pharmacy benefits like an expert. You will help prolong life or even better help save a life.

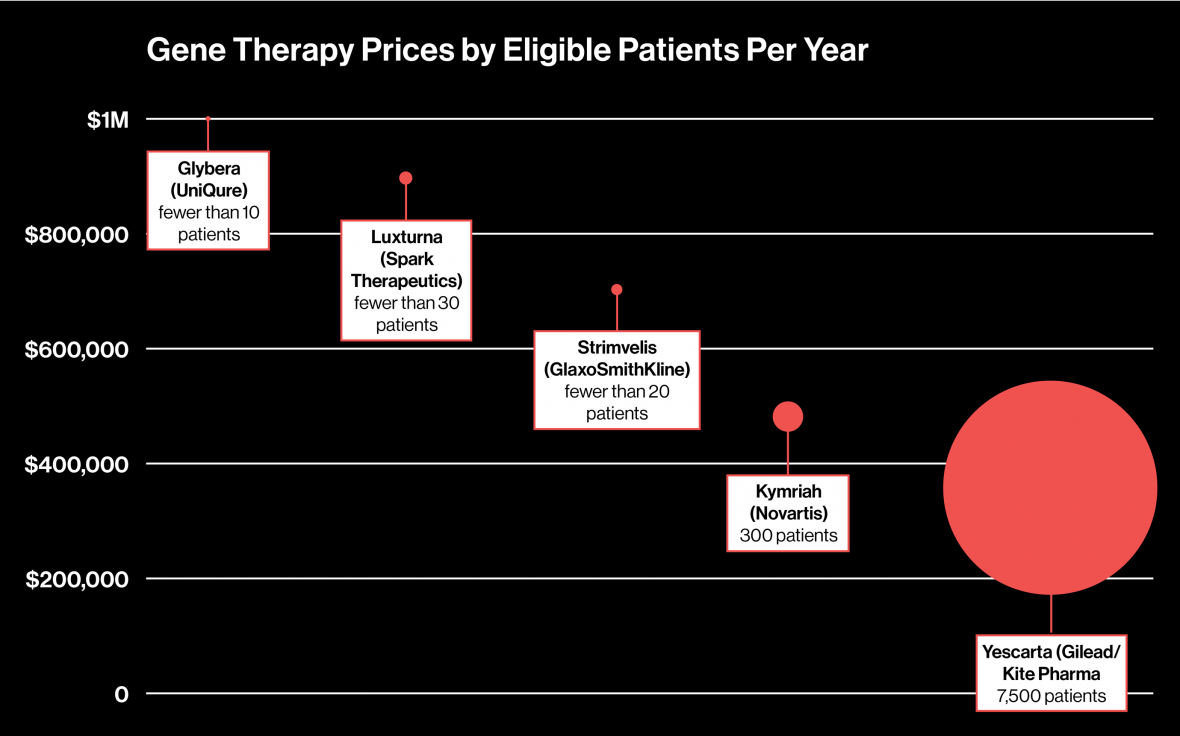

Since 2008, brand name drug inflation has increased 15 times faster than the Consumer Price Index. If you applied the same rate of inflation to a gallon of milk, you’d be spending around $12 instead of $4 or $5. Cost growth is even more pronounced in the medical drug category, where we’re seeing inflation of around 13 percent already in 2018. In other categories of spending, like physician or hospital services, the figures range from six to eight percent.