Reducing Wasteful Spending in Employers’ Pharmacy Benefit Plans; Special Report (Rerun)

Usually, the benefits design conversation is about keeping employees happy or limiting disruption to their benefits experience. It’s an appropriate conversation to have but certainly not the only one to be had around benefit design. If an employer closes off spread and rebate overpayments to a non-fiduciary PBM, sure enough the non-fiduciary PBM will look to make up for that lost revenue in the benefit design.

The Pacific Business Group on Health commissioned an excellent report, “Reducing Wasteful Spending in Employers’ Pharmacy Benefit Plans” which you must read. Here are a couple of recommendations from that report.

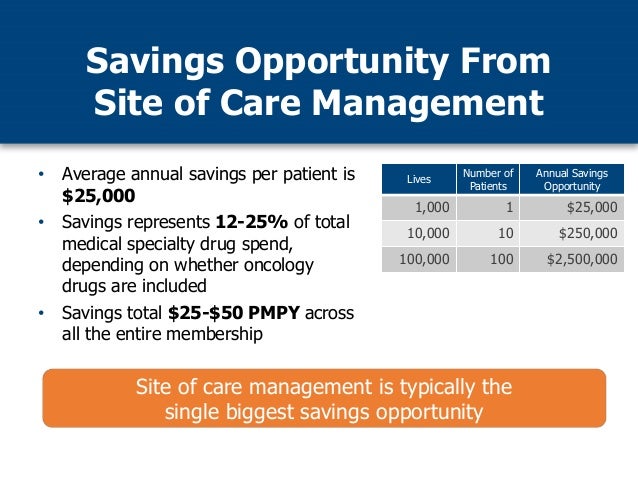

|

| Source: Pacific Business Group on Health |

| Non-fiduciary PBMs are good at this game! |

I had this discussion with a seasoned benefits consultant who couldn’t believe that this actually happens. That a PBM would poorly design a pharmacy benefit plan so to protect its revenue. He was surprised to learn that a PBM would take this route to protect its margins. I was taken aback that he was clueless to this ballooning tactic.

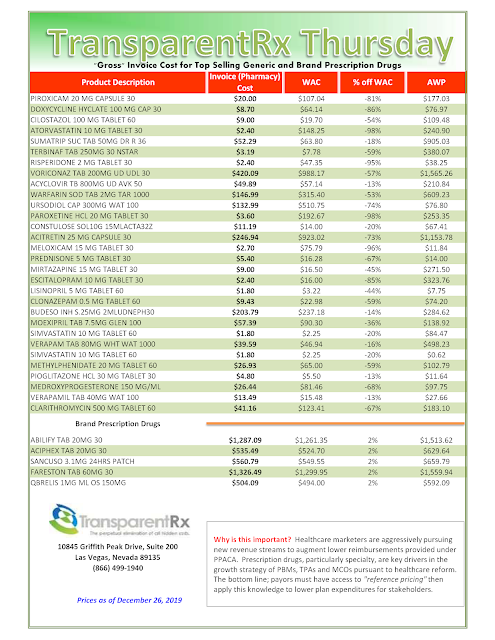

A good benefit design is one that is both cost-effective and gets medically appropriate drugs in the hands of patients. Cost-effectiveness is the act of saving money by making a product or performing an activity in a better way. It is easy for a PBM to get a medically appropriate drug in the hands of a patient yet that drug may not be cost-effective, for example.

One last word on #10 above. If your finance or accounting teams have not been properly trained, preferably by someone with PBM insider experience, then they too will leave money on the table. It’s a game of whack-a-mole with big stakes. Without training from a PBM insider, a non-fiduciary PBM will always beat you at that game.