The fundamental issue with PBM valuing, to kind of distil it out, is it is significantly more muddled than most purchasers might suspect. In the event that an individual not knowledgeable in evaluating PBM proposals takes a gander at PBM services agreement, it may have all the earmarks of being straight forward and basic, since they don’t comprehend what it is that they’re perusing.

Self-funded employers don’t need to sit tight for PBMs to provide full disclosure, in any case. They can employ continuous monitoring and watch for overpayments in house. Here are three basic spots overpayments happen that each payer should immediately act upon.

1) Tighten Up Contract Definitions

To genuinely forestall PBM overcharges, employers need to know and fully comprehend the fine print inserted in their agreement language. Numerous employers may think the meanings of “brand” and “generic” drugs are really standard. A brand drug is normally viewed as a patent-protected FDA-approved medication, while a generic or non-exclusive drug is a pharmaceutical that utilizes the same active ingredients as a brand drug that is not, at this point patent-protected.

That apparently standard definition, in any case, probably won’t be the one in your agreement. Some PBM contracts characterize a brand drug as a medication that is either patent-protected or one that has a single source generic, which could increase costs for employers. On the off chance that the PBM has changed the meaning of brand to incorporate single source generics, that viably implies more medications are estimated at the brand rate than should be. Therefore, the PBM’s clients likely could be following through on a brand cost when they ought to be addressing a much lower non-exclusive medication cost.

2) Make Sure You Have a Recent MAC List

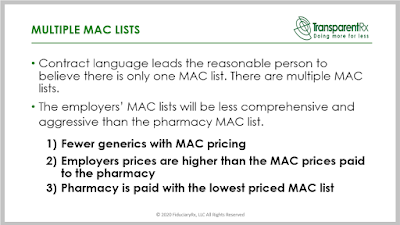

Another area self-funded employers are being overcharged is in the spread between retail pharmacy MAC Lists and the PBM’s MAC List. MAC lists determine the maximum allowable cost that a PBM plan will pay for generic drugs and multi-source brands. Overcharges occur when there is a spread between the MAC list used by a retail pharmacy and the one used by a PBM. For example, a pharmacy’s MAC list may price a drug as ten cents per tablet, but the PBM may charge seventeen cents per tablet.

|

| Click to Learn More |

Another potential problem is MAC pricing. The payer thinks that they’re getting a good deal because they have a MAC price, which is separate from the AWP minus or U&C pricing. MAC lists are supposed to protect employers from gaming by retail pharmacies. In reality, non-fiduciary PBM margins on MAC guarantees can be bigger than non-MAC’d drugs. What can self-funded employers do to prevent these types of overcharges? You should implement a continuous monitoring process. Continuous Monitoring or CM would have identified this problem before it got out of hand. Audits occur 12 -18 months after the fact which is too late to claw back the majority of overpayments. Continuous Monitoring on the other hand, catches and resolves overpayments or other issues much much faster.

3) Get All Manufacturer Revenue Earned

The intent of manufacturer revenue or rebates, on the buy-side, is to reduce the net cost of prescription drugs. When the PBM keeps a share, whether disclosed or undisclosed, self-funded employers pay more for those drugs. Non-fiduciary PBMs engage in renaming those dollars [rebates] in an attempt to deceive employers. The amount of rebates paid to an employer is only as strong as the definition for rebates in the contract. The non-fiduciary PBM will try to force your hand into accepting an opaque definition for rebates. Don’t do it.

In conclusion, PBMs will generally provide transparency and disclosure to a level demanded by the competitive market and rely on the demands of clients in negotiating their contracts. The best proponent of radical transparency or lowest net Rx cost is informed and sophisticated purchasers of PBM services. In other words, the more you know the less you pay. Unfortunately, most plan sponsors and their independent consultants don’t know what they don’t know.