About 15% of employers change brokers each year and likely double that stay with their broker even though they are not satisfied with the ROI. At the point when you consider the effect of the Covid-19 pandemic on staff, HR groups need now, like never before, to know their employee benefit brokers are genuine advocates and fully aligned in accomplishing HR goals. Here are three tips for employers and HR professionals to help pick the right insurance broker for pharmacy benefits.

1. Broker relies on technology.

2. Ask about conflict of interests.

If you’re reading this and work in HR or finance for a self-funded employer, never retain the services of a broker or PBM consultant who benefits when your pharmacy costs increase. Should you do so, be sure to have signed a conflict of interest disclosure form.

- Do you have the expertise within your company to evaluate PBM contract language?

- Do you have the skillset to design a pharmacy benefit plan? Or do you need additional training in pharmacy benefits management?

- Do you have the expertise and resources to manage the plan design or do you need to build in the incentives for the PBM to manage your program?

- How do you want to be involved in the management of the plan after it is set up?

A potential or actual conflict of interest exists when commitments and obligations are likely to be compromised by the broker’s other material interests, or relationships (especially economic), particularly if those interests or commitments are not disclosed. In other words, hire consultants not because you lack the requisite knowledge to design or manage the pharmacy benefit plan in-house, but because you lack the time or human capital to go it alone.

|

| Find Out More |

3. Check the credentials.

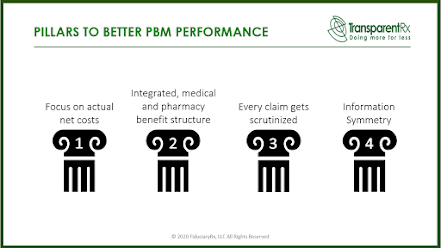

Many employers, unions, and government agencies pay large consultancies and brokerage firms to help them avoid overpaying for pharmacy services. So then how does this keep happening? There are a number of reasons including misaligned incentives, inefficient procurement and overall lack of a pharmacy benefits strategy just to name a few. But, the primary reason is without question a wholesale lack of education around pharmacy benefits management in general. It is education which leads employers to leveraging the four pillars to better PBM performance. When you hear an insurance broker say, “I know just enough about pharmacy benefits to be dangerous” run for the hills!

Education is key to use of lowest net cost drugs in pharmacy benefit plans. Only the most sophisticated purchasers of PBM services will have the knowledge and confidence to bind lowest net costs for prescription drugs into contract language and benefit design. Hence, your competitive advantage includes executing good analysis of the correct information then deciding what all of this suggests for your organization. Those who seize the chance and develop a good plan that may reasonably be accomplished have a higher probability of getting to lowest net cost.