Tip of the Week: How to Eliminate Huge PBM Markups and Reduce Pharmacy Costs by 50%

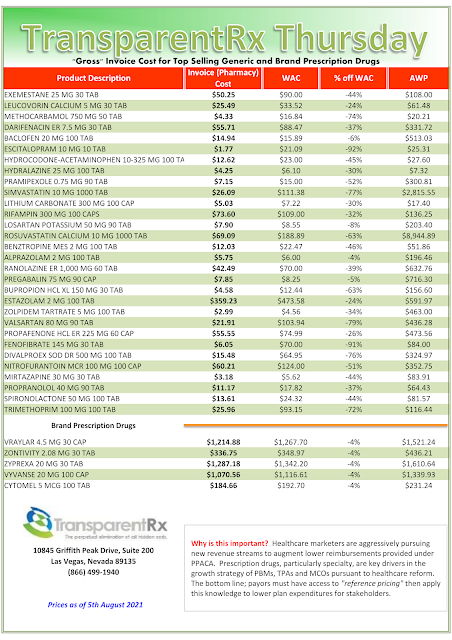

Generating more than $400 billion annually, the PBM industry offers a valuable service, providing pharmacy benefits to nearly 250 million Americans. Unfortunately, very few people outside of the industry fully understand how much money PBMs keep for themselves after the bills are paid.

|

| Click to Discover More |

PBM clients include, but are not limited to, commercial and public sector employers, unions, health plans and health systems just to name a few. All of the different PBM business models will profess how much money they can help plan sponsors save or that they are the most effective at improving your pharmacy benefit plan. However, very few of them share how much revenue they retain. Neither do they disclose their management fees.

Only two PBM business models will share their management fee – fiduciary or radically transparent PBM models. I mean, who are we kidding? Traditional, pass-through, and transparent PBM business models are for the most part the same. Do any of them reveal how much money they are being paid for their services? Think about this for a second. Contracts between pharmacy benefit managers and pharmaceutical manufacturers and pharmacies are pretty much set in stone. Unless a PBM significantly outperforms its contract, the terms between the PBM and manufacturer or pharmacy network will not change until the contract ends.

“The PBM’s Management Fee is the #1 metric in evaluating proposals and getting to the lowest net cost during an RFP.”

PBM Management Fee = AF (Administrative Fees) + DF (Dispensing Fees) + IC (Ingredient Costs) + MR (Manufacturer Revenue) – CD (Cash Disbursements)

For a PBM to outperform a contract with a pharmaceutical manufacturer, would require a significant change in market share, for example. Given this reality, what health plan sponsors are really negotiating for during renewal is what part of the discounts a PBM has secured you will allow that same PBM to keep. The part a PBM retains is its management fee.